How I Spent My Money In 2017

Where do I begin? 2017 was a mixed bag in terms of spending and saving, and the raw results are a bit ugly on the surface. My spending increased by 4.6 percent and my savings rate was an abysmal 12.3 percent, down from 31.8 percent in 2016. I also missed on two of the three goals I set in my post from last year.

1.) [X] Take on a home renovation project, like a bathroom or kitchen remodel.

2.) [ ] Reduce spending on Health & Fitness.

3.) [ ] Reduce spending on Food.

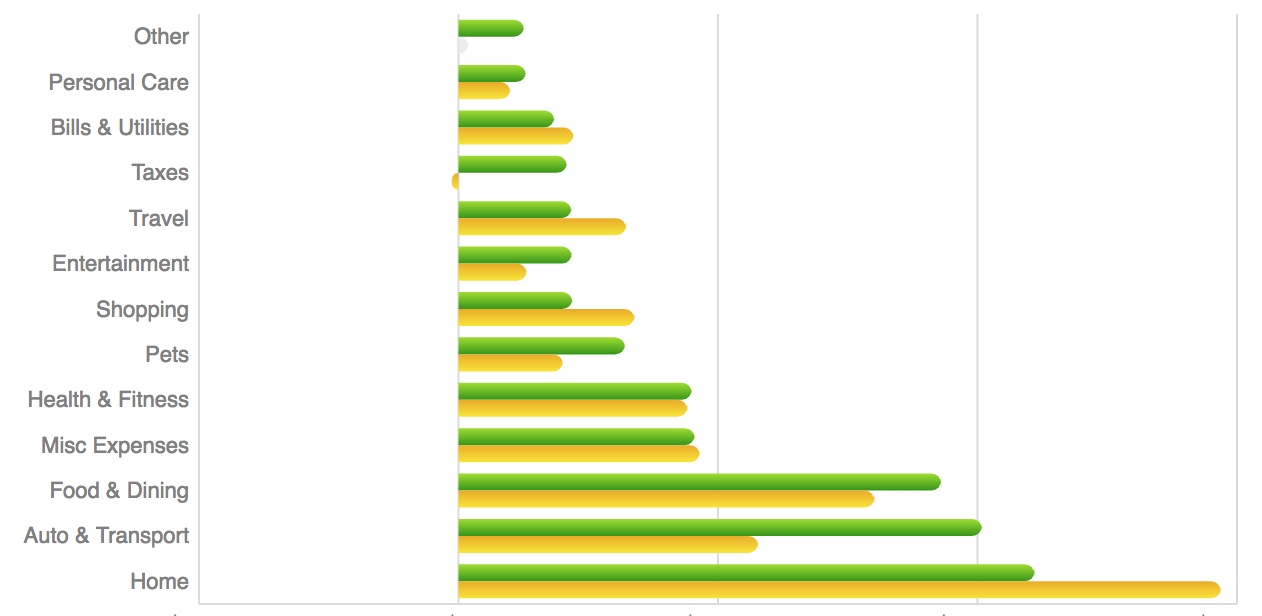

Details on the hits and misses below. First, here's is the full breakdown of 2017 spending. As I with last year, I used percentages of my net income rather than dollar amount.

NOTE: Taxes include property taxes, but exclude income taxes.

2017 spending (green) vs. 2016 spending (orange)

One thing that stands out immediately: I spent significantly less on Home while I spent significantly more on Auto & Transport in 2017 compared to 2016. Both of these shifts contribute to, and even exaggerate, my plummeting savings rate this year. A few notes on my top 5 categories:

Auto & Transport (18%): Why was this a top spending category of 2017? Because I decided to aggressively pay off my car, which I bought used in 2014. From a financial freedom standpoint, this was a great move: reduce debt to zero as fast as possible. It also felt really good; however, from a return-on-investment standpoint, it was a dumb decision. Had I taken the same the dollar amount and bought mutual funds, the odds are that I would make 4 to 10 percent over the course of a few years. On top of that, paying off a car - even if it's principal - does not count towards savings since it's a depreciating asset. That's why my savings rate is a bit sad in 2017 compared to 2016, when I paid a large amount of principal on my house.

My actual shitty windows

Home (20%): I'm fairly happy with where the numbers landed in Home. It's an interesting category, because Mint captures not only mortgage and rent payments but also home furnishings, cleaning services, repairs, etc. This year, I had a few small repairs and put a downpayment on new windows. If you talked to me even semi-regularly in the last six months, I'm sure I talked your ear off about the saga of replacing windows in a St. Louis City historic district. That's why moving forward with this project is one of my biggest (and most boring) personal accomplishments of 2017 and something I'm very excited about in 2018. I cannot wait to ditch the rotting, drafty windows that I look at every day!

I also made the decision to hire a house cleaner. If you had asked me about it a year ago, I would've insisted on rolling up my sleeves and doing it myself to save a few bucks. But as my free time dwindled and my mental state reflected my messy house, I went for it and haven't looked back. Now I am a more relaxed person and most of all, a better partner and friend.

Food and Dining (17%): I know I should get on top of this, but life is short and so is time (though I realize this is coming from a place of extreme privilege). Right around the time I hired a house cleaner, I also started buying pre-made meals; this saves me 3-4 hours of total time each Sunday. I imagine I was on track to reduce spending in this category, but I'm completely okay with missing the goal for now.

Investments (8%): This number should be much higher, potentially double. I need to prioritize saving for retirement in 2018, since paying off loans and home improvement took precedence this year.

Health & Fitness (8%): I wanted to reduce spending in this category, but the overall number stayed flat despite cutting costs on gyms and classes by 10 percent. Health, after all, is somewhat unpredictable. This year, I broke my pinky, which required extra doctors visits and physical therapy. And one of my biggest health expenses in 2017? Contact lenses and glasses. Woof.

Last Thoughts and Plans for 2018

One thing I learned about myself this year is that I'm a control freak. When other things are far beyond my control, taking charge over my finances is one way I can regain that feeling. And I can do it all from the couch while binge-watching The Sopranos with two dogs! That's what I did today.

I know the results of 2017 don't look great on the surface, but I'm glad to have reduced my loan debt by 11.1 percent while living a great life: seeing friends and family as much as possible, trying great restaurants and bars, and treating my dogs like kings. I've got plenty of work to do in 2018, but for now, the plan is mostly the same: keep spending flat (or reduce it) and save, save, save.

Hold yourself accountable, my friends.